Life Insurance in and around Vincennes

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

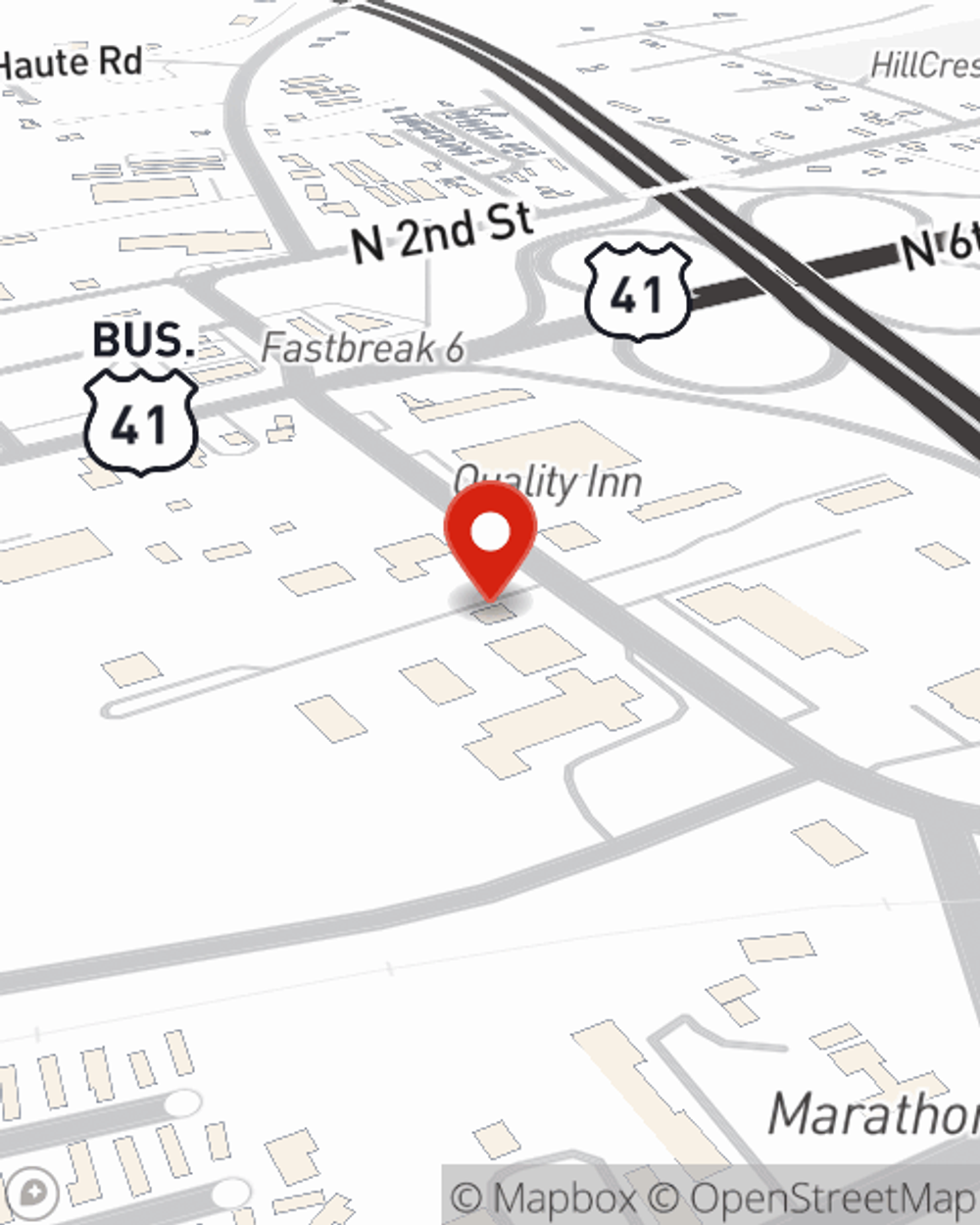

- Vincennes, Indiana

- Monroe City, Indiana

- Lawrenceville, IL

- St. Francisville, IL

- Bruceville, IN

- Wheatland, IN

- Ragsdale, IN

- Decker, IN

- Hazleton, IN

- Oaktown, IN

- Bicknell, IN

- Allendale, IL

- Patoka, IN

- Petersburg, IN

- Bridgeport, IL

- Washington, IN

- Edwardsport, IN

- Plainville, IN

- Freelandville, IN

- Sumner, IL

- Francisco, IN

- Westphalia, IN

- Princeton, IN

- Sandborn, IN

State Farm Offers Life Insurance Options, Too

When you're young and a recent college graduate, you may think you don't need Life insurance. But it's a perfect time to start thinking about Life insurance to prepare for the unexpected.

Protection for those you care about

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific time frame coverage for a specific number of years or another coverage option, State Farm agent Tammy Wilson can help you with a policy that works for you.

Did you know that there's now a life insurance option available that's perfect for anyone who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really prove useful when it comes to paying for final expenses like medical bills or funeral costs. Don't let these expenses be a burden on your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Tammy Wilson and see how you can be there for your loved ones—no matter what

Have More Questions About Life Insurance?

Call Tammy at (812) 882-2000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Tammy Wilson

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.